Spain has consolidated its position as the dominant force in feed production in Europe, manufacturing 38.8 million tons of compound feed in 2024, according to data from the Ministry of Agriculture, Fisheries and Food. This remarkable achievement represents a year-on-year growth of 1.5 % compared to 2023, demonstrating the resilience and continued expansion of the Spanish feed sector, even as the European Union experienced a 0.4 % decline in feed production.

The Spanish feed industry forms the backbone of the country's robust livestock production system, providing specific nutritional requirements for millions of animals of various species. Compound feeds, which are carefully formulated blends of raw materials designed to meet the precise nutritional needs of livestock at different life stages, represent the foundation of modern agricultural efficiency. This sector not only supports national livestock producers, but also positions Spain as a strategic supplier within the European Feed Manufacturers Federation network.

Spain's position as Europe's Leading Feed Producer

According to data from CESFAC (Spanish Confederation of Compound Feed Manufacturers), Spain maintains its leadership as the largest producer of compound feed in the European Union. The country's total production in 2024, 38.8 million tons, significantly exceeds other major European producers, with Germany, France and the Netherlands lagging behind in production capacity.

Statistics from the European Feed Manufacturers Federation reveal that, while EU compound feed production decreased by 0.4 % in 2024, Spanish production continued its upward trend. This growth represents approximately 15 % of the total volume of compound feed production in the EU, highlighting Spain's crucial role in ensuring the security of feed supply in European livestock markets.

Compound feed is the basis of modern livestock production, providing animals with balanced nutrition that promotes optimal growth, health and productivity. The Spanish industry's experience in feed formulation and production processes has enabled livestock producers to achieve higher efficiency rates compared to traditional methods using individual raw materials.

The success of Spanish feed production is due to several factors, including proximity to major livestock breeding areas, access to Mediterranean ports for importing raw materials and a well-developed network of feed mills strategically located throughout the country. This infrastructure supports the specific nutritional requirements of different species while maintaining cost-effective distribution networks.

Breakdown of Production by Animal Species

Compound feed production in Spain shows a clear pattern of specialization, with swine feed dominating the market with 46.87 % of the total, equivalent to approximately 18.2 million tons in 2024. This reflects Spain's position as the largest pork producer in Europe, with a pork industry that requires substantial volumes of high-quality compound feed to maintain its competitive edge.

The cattle feed represents 20.78 % of production, or around 8.1 million tons per year. This segment caters to both dairy and beef cattle production, with specific formulations designed to meet the nutritional demands of different breeds and production systems. The cattle feed sector has remained relatively stable, with slight fluctuations based on changes in livestock population and improvements in feed efficiency.

Poultry feed accounts for 19.85 % of total production and has shown remarkable growth with an increase of 5.1 % in 2024. This upward trend reflects the growing domestic and export demand for poultry products, as well as the expansion of modern poultry operations that rely heavily on precisely formulated compounded feeds to achieve optimal feed conversion ratios.

The remaining volume is used for other species, including sheep, goats, rabbits and rabbits. aquaculture. Fish feed production has gained particular attention due to the expansion of the Spanish aquaculture sector, which requires specialized formulations that differ significantly from terrestrial animal feeds. These niche markets, although smaller in volume, often command premium prices due to their specific nutritional requirements.

| Animal Species | Percentage of Total Production | Approximate Volume (Millions of Tons) |

|---|---|---|

| Swine | 46,87 % | 18,2 |

| Cattle | 20,78 % | 8,1 |

| Poultry | 19,85 % | 7,7 |

| Other species: These include smaller volume specialty feed markets, such as aquaculture, which demand premium prices due to specific nutritional requirements. | 12,5 % | 4,8 |

The predominance of swine feed production is aligned with Spain's agricultural specialization, where swine production generates significant export revenues and supports rural economies, especially in regions such as Catalonia and Aragon. This specialization has driven innovations in feed efficiency and nutritional optimization specifically for swine production systems.

Historical Trends and Production Evolution (2019-2024)

Analysis of CESFAC's annual reports reveals a steady growth trajectory in Spanish feed production over the past five years, despite the challenges posed by the COVID-19 pandemic and subsequent supply chain disruptions. The sector showed remarkable resilience, quickly recovering production volumes after the initial impact of 2020.

| Year | Total Production (Millions of Tons) | Growth Rate (%) | Main Developments |

|---|---|---|---|

| 2019 | 36,2 | +2,1 % | Pre-pandemic base growth |

| 2020 | 35,8 | -1,1 % | Impact of COVID-19 on demand |

| 2021 | 36,9 | +3,1 % | Recovery and adaptation |

| 2022 | 37,8 | +2,4 % | Supply chain standardization |

| 2023 | 38,2 | +1,1 % | Continued stable growth |

| 2024 | 38,8 | +1,5 % | Consolidation of leadership |

The COVID-19 pandemic initially affected feed production in 2020, with a temporary decline of 1.1 % as livestock producers adjusted to new market conditions and export restrictions. However, recovery was rapid, with 2021 showing the highest growth rate of 3.1 % due to demand recovery and the opening of new markets.

Compared to other major EU producers, Spain has consistently outperformed regional averages. While Germany and France experienced more volatile production patterns, Spain's diversified sector and strong domestic demand provided stability. The Netherlands, although smaller, has shown comparable efficiency metrics, but lacks Spain's productive scale.

Key factors driving Spain's sustained leadership position include strategic investments in feed mill modernization, the adoption of precision nutrition technologies and strong integration between feed manufacturers and livestock producers. The industry has also benefited from a favorable geographical position for importing raw materials and efficient distribution networks.

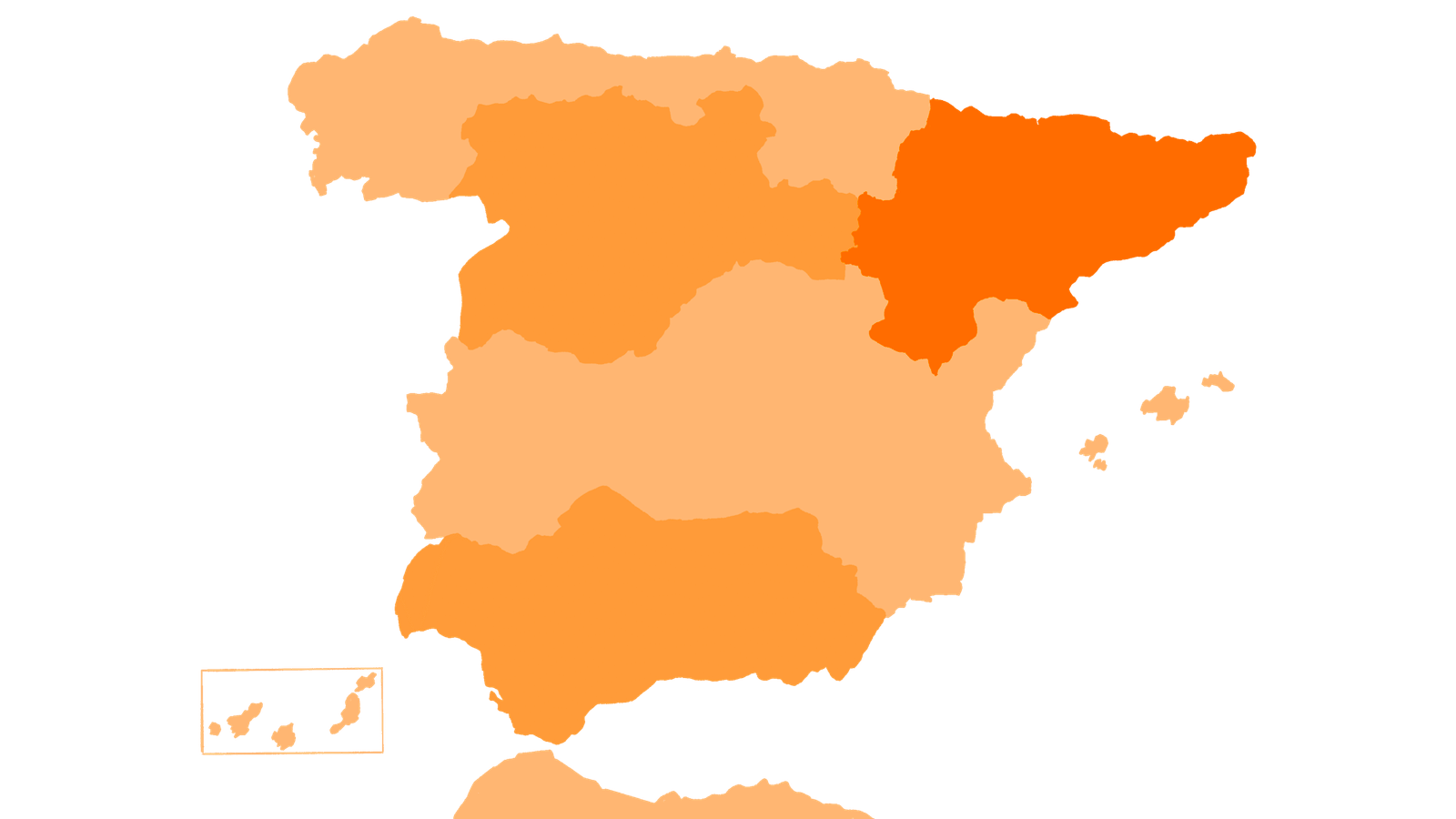

Geographical Distribution of Feed Production in Spain

The geographic distribution of Spanish feed production closely mirrors the country's livestock breeding concentrations, with Catalonia and Aragon leading in production capacity. These northeastern regions account for approximately 35 % of total national production, driven primarily by their dominant swine operations.

Catalonia is home to numerous major feed mills and functions as a center for the production of compound feed, with facilities strategically located near important ports for the import of raw materials and close to intensive livestock breeding areas. The region's production capacity exceeds 12 million tons per year, making it the largest single regional producer in Spain.

Aragon follows closely behind with significant capacity concentrated around its extensive pork operations. The region benefits from an excellent transportation infrastructure that connects production facilities with raw material suppliers and livestock customers throughout Spain and neighboring European countries.

Castilla y León represents an important center of livestock feed production, with numerous factories specializing in dairy and beef cattle nutrition. The region's agricultural tradition and extensive pasture areas support both cattle breeding and feed ingredient production, creating an integrated agricultural ecosystem.

Andalusia contributes substantially to total production, with feed mills serving diverse livestock operations, including cattle, swine and, increasingly, aquaculture along the Mediterranean coast. The region's strategic position provides access to both Atlantic and Mediterranean markets.

The total number of feed mills in Spain amounts to approximately 750 facilities, ranging from large plants producing more than 100,000 tons per year to smaller regional facilities serving local markets.

Transportation infrastructure plays a crucial role in feed distribution, with major highways and rail networks connecting production centers with livestock breeding areas. Proximity to major ports in Barcelona, Valencia and Seville facilitates the efficient import of raw materials, especially protein sources and specialty ingredients not produced locally.

Raw Materials and Ingredient Supply

Spanish feed production relies on a balanced mix of domestic agriculture and strategic imports to meet raw material needs. Cereals form the basis of compound feed, with corn (35 %), wheat (20 %) and barley (15 %) being the key ingredients.

Domestic grain production supplies about 60 % of grain demand, with imports from Ukraine, Brazil and Argentina covering the remainder. Protein sources are mainly imported, with soybean meal accounting for 95 % of protein inputs, mainly from Brazil, Argentina, and the United States. Efforts to increase domestic protein crops such as legumes, sunflower and rapeseed support circular economy objectives.

Challenges in the supply chain, including geopolitical conflicts and price volatility, have led manufacturers to diversify suppliers, secure long-term contracts and invest in storage. The industry also incorporates by-products from the food industry into feed when permitted, reducing waste and environmental impact.

Economic Factors Influencing the Spanish Feed Industry

Fluctuations in global commodity prices, especially corn and soybean meal, challenge Spanish feed manufacturers. To manage risks, the industry uses forward contracts, commodity hedging and strategic inventory management.

Exchange rates also impact the costs of imported raw materials, with companies employing financial hedges to maintain competitiveness in domestic and export markets.

Government support, including subsidies from the EU's Common Agricultural Policy and promotion of protein crops, provides economic stability and encourages domestic raw material production and industrial development.

Export markets in North Africa, the Middle East and the Mediterranean are expanding, with Spanish feed manufacturers leveraging technical expertise and quality to offer premium products internationally.

Investment in modernization and capacity expansion continues in a robust manner, focusing on automation, environmental compliance and production efficiency to maintain long-term competitiveness and meet evolving regulatory and sustainability objectives.

Structure of the sector in Spain

Market concentration shows a balanced industry with large multinationals alongside medium-sized regional producers and cooperatives. The major producers manufacture more than 500,000 tons annually, with the top 10 accounting for about 45 % of total production, while regional players focus on niche markets and maintain local relationships with farmers. Cooperative structures are particularly important, operating about 30 % of production capacity and often integrating feed manufacturing directly with livestock farming.

Levels of integration vary across the industry; some large agribusiness companies span feed manufacturing, livestock production and meat processing, while others focus solely on feed production. Research institutions and universities collaborate closely with manufacturers on nutritional science, production efficiency and sustainability challenges, driving technological advancement. One example is the experimental plant at IRTA (Food Research and Technology Institute) built by Rosal Mabrik, which is used for research and development in manufacturing technology and animal nutrition, facilitating innovation in the sector.

Technology adoption in Spanish feed mills is high, with automation systems, quality control technologies and data management platforms becoming standard, improving efficiency, product consistency and traceability. The industry maintains strong relationships with livestock producers through technical service teams that provide nutritional consulting, feed optimization advice and production support, creating value-added relationships beyond simple commodity supply.

As a leader in the Spanish feed production market, Rosal Instalaciones Agroindustriales has more than 60 years of experience in Spain and its brand is present in approximately 80 % from the country's feed mills.

Future Outlook and Market Projections

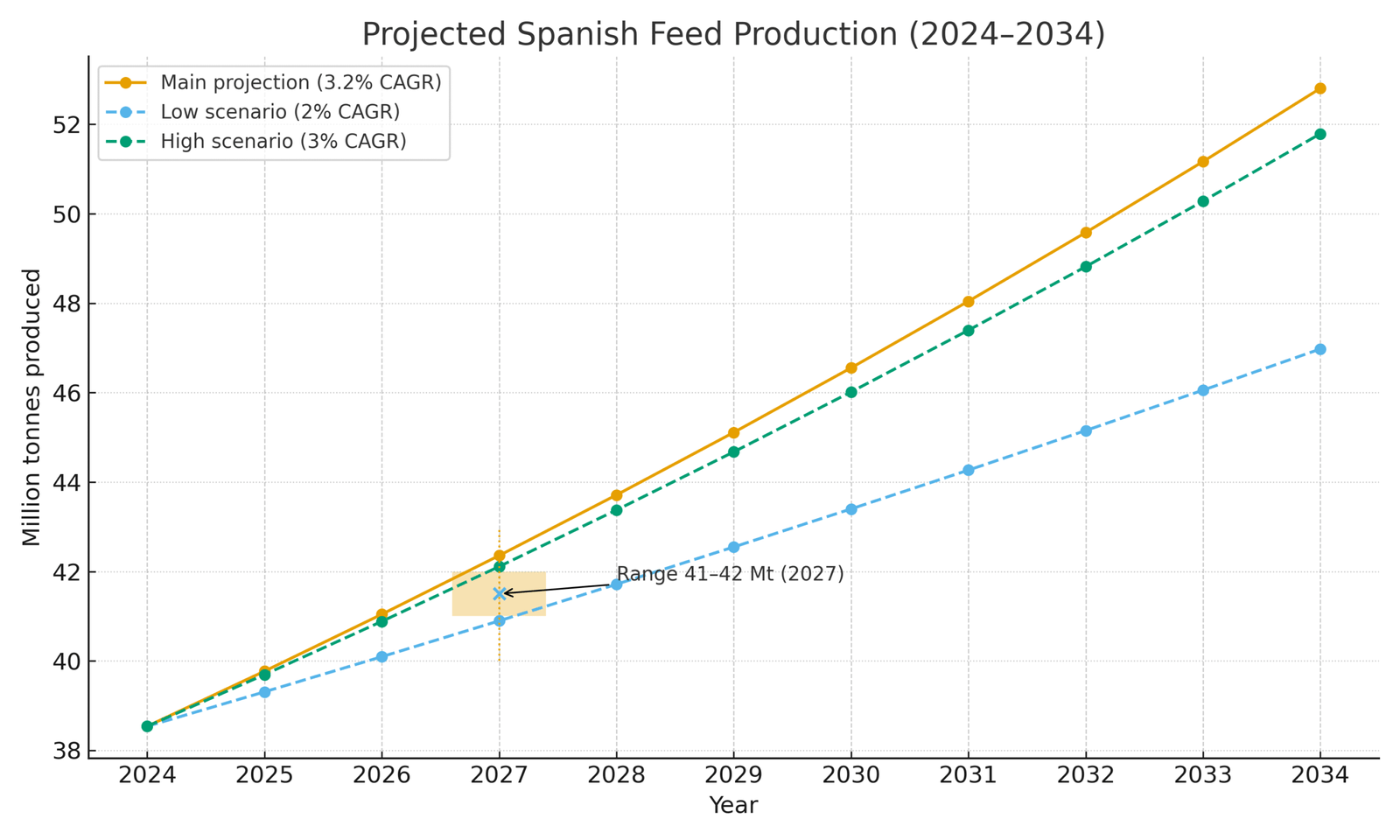

CESFAC projects steady growth for Spanish feed production through 2027, with volumes potentially reaching 41-42 million tons. This growth, at an annual rate of 2-3 %, is driven by expanding livestock populations and improvements in feed efficiency. Demand for poultry feed is forecast to grow faster, at 4-5 % per year, reflecting the increase in poultry meat consumption and the expansion of modern facilities. Swine feed demand is expected to remain stable, with modest growth supported by efficiency gains in swine production.

Alternative protein sources present both challenges and opportunities; however, their current market penetration is minimal and unlikely to significantly impact feed demand within the forecast period. Climate change poses risks to raw material availability, prompting manufacturers to adopt diversified sourcing strategies and increase storage capacity to manage supply disruptions.

Technology investments, including precision nutrition systems, automated production and data analytics, will drive improvements in efficiency and reduced environmental impact. Regulatory changes are anticipated in the EU that will strengthen sustainability requirements, antibiotic restrictions and traceability mandates. Spanish feed producers are proactively improving their compliance capabilities to maintain market access and competitiveness.

Spain's strategy to sustain its European leadership focuses on technological innovation, sustainability and market diversification. Its geographic advantages, established infrastructure and technical expertise position the country to adapt to changing market conditions while preserving its dominant role.

With a projected compound annual growth rate of 3.2 % from 2025 to 2034, Spanish feed production could reach about 49.3 million tons by 2034. This outlook reflects Spain's strong competitive position in livestock agriculture and efficiency in feed manufacturing.

Overall, the Spanish feed sector demonstrates resilience and adaptability, combining strategic positioning, innovation and sustainability to ensure continued growth and leadership in European compound feed production.

References

- Ministerio de Agricultura, Pesca y Alimentación, Spain - Feed Production Data 2024

https://www.mapa.gob.es/es/agricultura/temas/producciones-agricolas/ - Pig333 - Spain Remains Europe's Leading Feed Producer (September 23, 2025)

https://www.pig333.com/latest_swine_news/spain-remains-europes-leading-producer-of-animal-feed_21790/ - Tridge News - Spain Remains Europe's Largest Feed Producer (September 23, 2025)

https://www.tridge.com/news/spain-continues-to-be-the-largest-producer-o-kmfwty - European Feed Manufacturers Federation (FEFAC) - Statistics and Reports

https://www.fefac.eu/statistics/ - CESFAC (Spanish Confederation of Compound Food Manufacturers) - Annual Reports and Market Data

https://cesfac.es/es/quienes-somos/el-sector-en-cifras - AHDB - Feed Production Market Outlook (September 2025)

https://ahdb.org.uk/animal-feed-production-market-outlook - Feed & Additive Magazine - Global Animal Feed Market Overview

https://www.feedandadditive.com/global-animal-feed-market - Confederation of Agricultural Industries (AIC) - Animal Feed Industry Information

https://www.agindustries.org.uk/sectors/animal-feed.html - La Vanguardia - Information on Feed Mill Machinery from Rosal Instalaciones Agroindustriales

https://www.lavanguardia.com/economia/20230321/8839866/grupo-rosal-factura-35-millones-fabricas-maquinaria-piensos.html - Polaris Market Research - Global Animal Feed Market Forecast

https://www.polarismarketresearch.com/industry-analysis/animal-feed-market - Mordor Intelligence - Animal Feed Market Report

https://www.mordorintelligence.com/industry-reports/animal-feed-market - Future Market Insights - Animal Feed Market Size and Forecast

https://www.futuremarketinsights.com/reports/animal-feed-market - Precedence Research - Animal Feed Market Analysis Report

https://www.precedenceresearch.com/animal-feed-market